Succession Planning – A How to Guide

March 28, 2018

You wouldn’t run a business without insuring your IT equipment. Yet many organisations fail to plan for the vacancy of critical positions. All businesses need to be ready to react to expected and unexpected departures alike and succession planning is a great way to do this.

In this how-to guide, we explore the considerations and practical steps you need to take to secure your business’ most critical resource.

Ready to Respond

Critical roles can be hard to fill. Finding a new CEO or Finance Director will take most firms months, not weeks, and in that timeframe, anything could happen. Succession planning is a great way to insure your business against the risks of operating without key roles or with untrained people filling gaps on a temporary basis.

By identifying those roles that are key to the success of your business and deciding who is best placed to fill each person’s shoes, you can insure your business’ continuity no matter who leaves.

The Succession Planning Process

Good succession plans consider the short, medium and long-term. By identifying immediate replacements and ensuring a pipeline of talent ready to fulfil vacant roles in the years ahead, you’ll be well-placed to respond to any eventuality.

There are a number of key considerations to attend to:

Be strategic – identify the current and future needs of the business based on your company’s vision. This will include not only succession but skills too and should link with your recruitment plan.

For example, an IT firm might want to expand its services to include Virtual Reality yet lacks the skills to deliver this technology. Identifying this gap enables the business to upskill existing employees or attract suitable new recruits.

Identify critical roles – the CEO and their direct reports are always critical but remember to identify lower level roles too. There may be a specialist at a lower grade with skills you couldn’t survive without or a role that’s particularly difficult to recruit for.

Work out timings – while retirement dates are no longer enforceable everyone will stop working at some point. Build estimated retirals into your planning and ensure managers advise of anyone who is thinking about leaving.

Use your data – identify talent by assessing performance reviews or conducting new surveys with managers.

Consider motivation – not all employees want to progress their careers. As part of the appraisal process ensure managers discuss employees’ career aspirations to understand whether it’s worth adding them to a succession plan. If you include them without understanding their career intentions, you could end up with an unexpected gap.

Now You’re Ready to Get Started

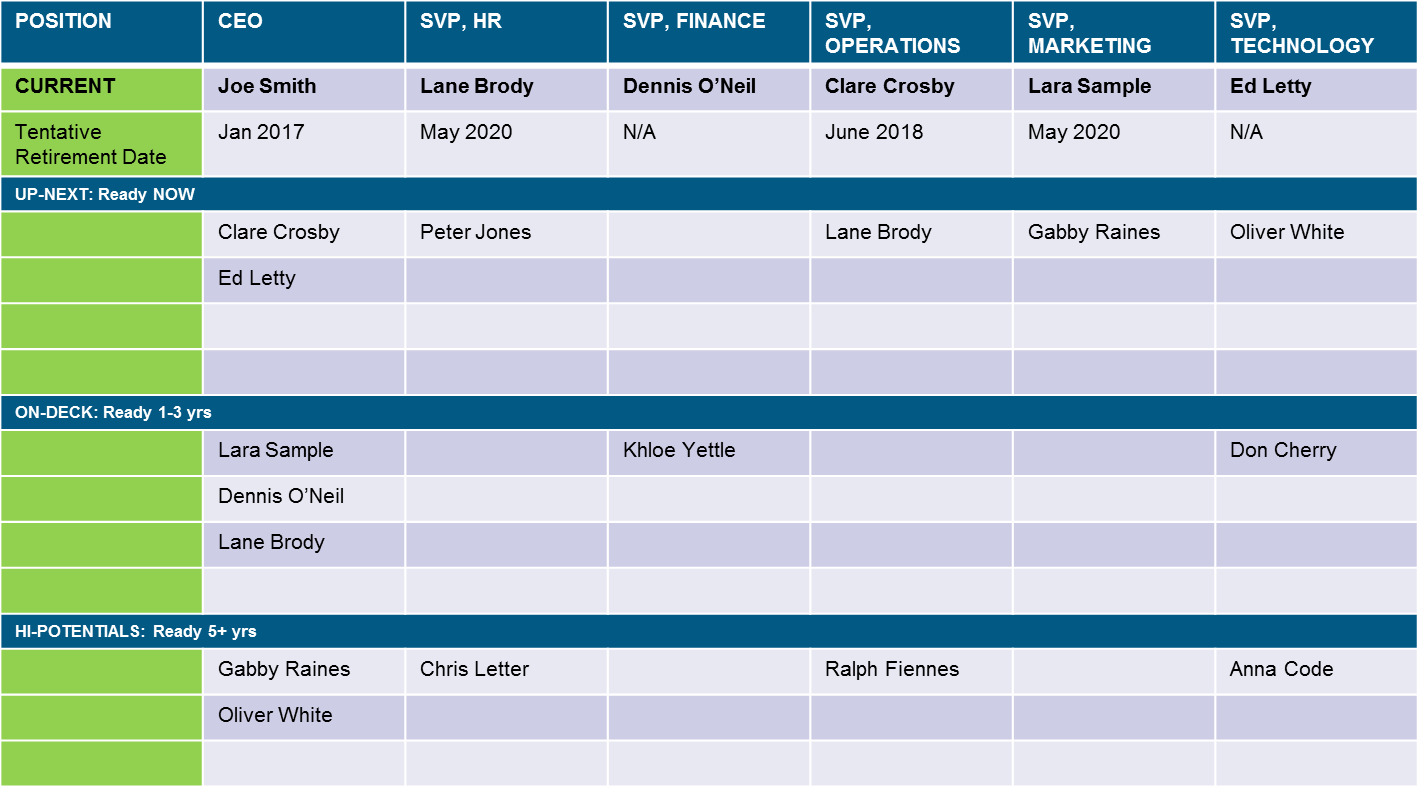

Succession planning doesn’t have to be complicated. Creating a simple spreadsheet with the key roles you need to replace will be sufficient. As in the image below, identify who is ready to take over each role, who needs one to three years and five or more years to be ready to step up.

Source: Sigma Assignment Systems

http://www.sigmaassessmentsystems.com/wp-content/uploads/2016/03/successionplanningtemplate.png

Once you’ve identified any skills and experience gaps in your plan, you need to take action to fill them. This could mean:

- Developing a training plan for key individuals

- Exposing potential candidates to more senior colleagues

- Providing experience of different working practices

- Involving successors in larger or more strategic projects

- Ensuring replacements have sound financial knowledge

Depending on your company culture, these meetings can sometimes become combative as managers seek to present one of their team as the next best choice for a particular role.

If you’re running the meeting, be prepared to take a firm but fair hand to resolve any disagreements. Alternatively, you could secure an external facilitator experienced in managing the process.

Succession Planning and Re-evaluation

Succession plans shouldn’t be locked away in a draw. Revisit them regularly to ensure they are still fit for purpose and that the people identified as successors still work for your organisation.

Reviewing the plan every six months is a good rule of thumb unless you work in an industry with high turnover or that regularly reorganises. In these instances, you may need to review your plan quarterly.

Why Bother When You Can Recruit?

Bringing new blood into an organisation can be helpful and even with your succession plan, you will still need to do this. However, it can often be better to look internally to fill a position because it:

- Creates career opportunities for existing employees

- Boosts engagement by demonstrating that you are prepared to promote from within

- Retains knowledge within your organisation and not your competitors’

- Reduces the time it takes for a new person to get up to speed

- Minimises the additional recruitment costs associated with hiring more senior roles

Whether you decide to communicate your succession plan to named individuals is up to you. While it can be inspiring for individuals to know that they have been earmarked, it can also be upsetting if plans change and they are no longer designated for succession.

Succession planning is an integral part of business risk management. By aligning your people with your strategy you’ll be prepared for the future. And your plans will give you the comfort of a fallback position whatever happens.

If you’d like the support of an experienced HR consultant to establish or conduct your succession planning process, contact Tercus HR on 0330 555 1139 or email at hello@tercushr.co.uk.